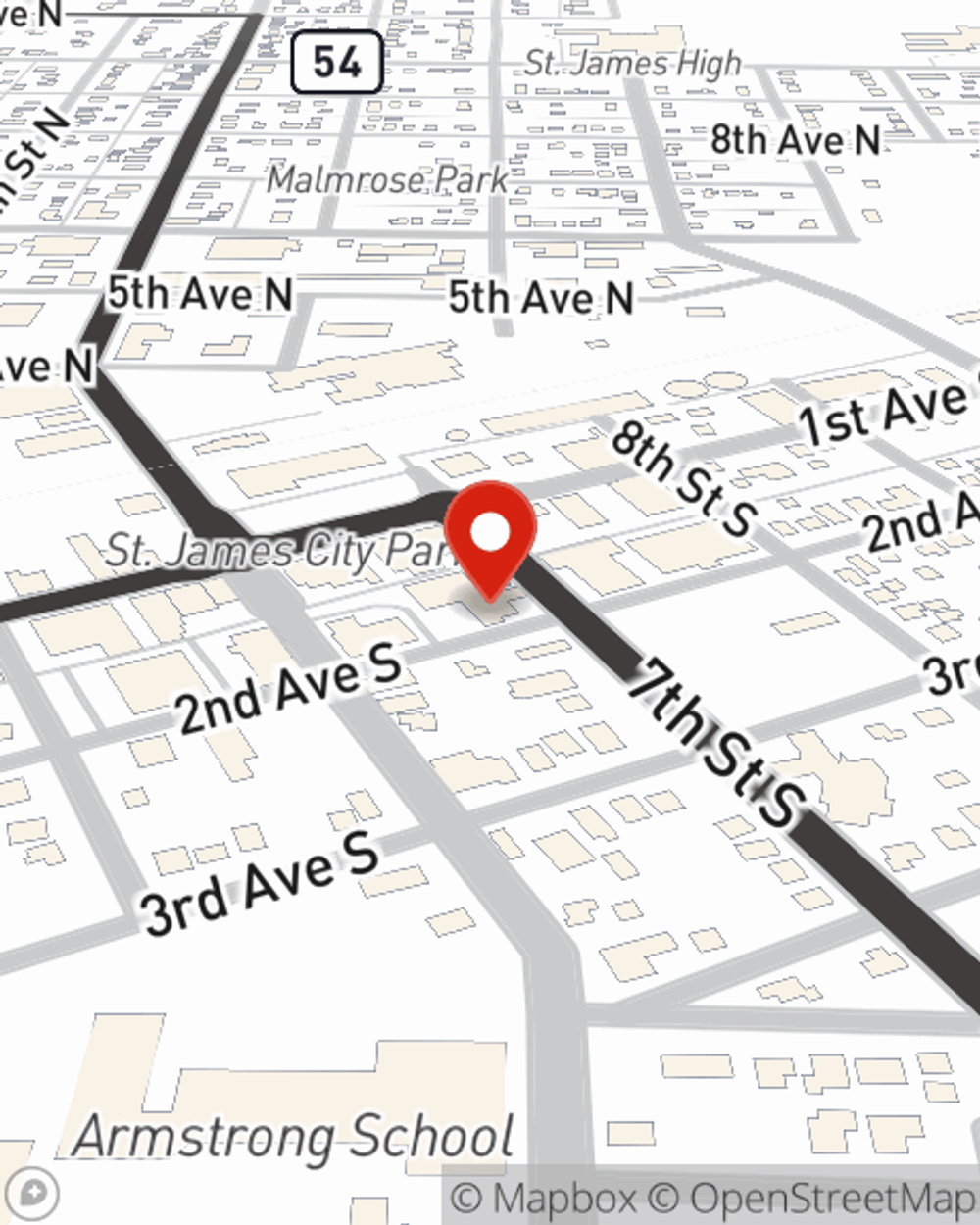

Homeowners Insurance in and around St James

St James, make sure your house has a strong foundation with coverage from State Farm.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

Home Is Where Your Heart Is

Your home and possessions have monetary value. Your home is more than just a roof and four walls. It’s all the memories attached to every room. Doing what you can to keep your home protected just makes sense! And one of the most reasonable things you can do is to get excellent homeowners insurance from State Farm.

St James, make sure your house has a strong foundation with coverage from State Farm.

Give your home an extra layer of protection with State Farm home insurance.

Homeowners Insurance You Can Trust

Are you looking for a policy that can help cover both your home and your memorabilia? State Farm agent Keith Boeve's team is happy to help you generate a plan that's right for your needs.

Your home is the place where your loved ones gather, but unfortunately, the accidental circumstance may occur. That's why you need State Farm's homeowners insurance. Plus, if you need some more air space, our bundle and save option could be right for you. Keith Boeve can help you get the home coverage you need!

Have More Questions About Homeowners Insurance?

Call Keith at (507) 375-3277 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to clean gutters and downspouts safely

How to clean gutters and downspouts safely

Regular gutter cleaning may help you avoid expensive repairs to your home and yard. Learn how to clean gutters safely.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.

Keith Boeve

State Farm® Insurance AgentSimple Insights®

How to clean gutters and downspouts safely

How to clean gutters and downspouts safely

Regular gutter cleaning may help you avoid expensive repairs to your home and yard. Learn how to clean gutters safely.

Is renters insurance required?

Is renters insurance required?

Renters insurance protects more than your belongings in the event of a loss. Learn about what renters insurance covers and how it can help you.